Facts About Estate Planning Attorney Revealed

Table of ContentsSome Known Questions About Estate Planning Attorney.Not known Facts About Estate Planning AttorneySome Known Details About Estate Planning Attorney Indicators on Estate Planning Attorney You Need To Know

Estate planning is an activity strategy you can make use of to determine what happens to your possessions and responsibilities while you're active and after you die. A will, on the other hand, is a legal file that lays out how possessions are dispersed, that cares for youngsters and family pets, and any kind of various other dreams after you pass away.

Insurance claims that are denied by the executor can be taken to court where a probate judge will have the last say as to whether or not the claim is legitimate.

The 45-Second Trick For Estate Planning Attorney

After the stock of the estate has been taken, the worth of assets calculated, and taxes and debt repaid, the administrator will certainly after that look for consent from the court to disperse whatever is left of the estate to the beneficiaries. Any type of estate taxes that are pending will come due within 9 months of the day of fatality.

Each specific places Visit Website their assets in the trust and names someone other than their partner as the recipient., to sustain grandchildrens' education and learning.

Fascination About Estate Planning Attorney

This approach involves cold the value of a possession at its worth on the day of transfer. Appropriately, the quantity of potential funding gain at fatality is also iced up, allowing the estate organizer to estimate their possible tax responsibility upon fatality and much better prepare for the repayment of revenue tax obligations.

If adequate insurance policy proceeds are offered and the plans are correctly structured, any type of revenue tax on the considered dispositions of properties following the death of an individual can be paid without turning to the sale of possessions. Profits from life insurance coverage that are gotten by the recipients upon the fatality of the insured are generally earnings tax-free.

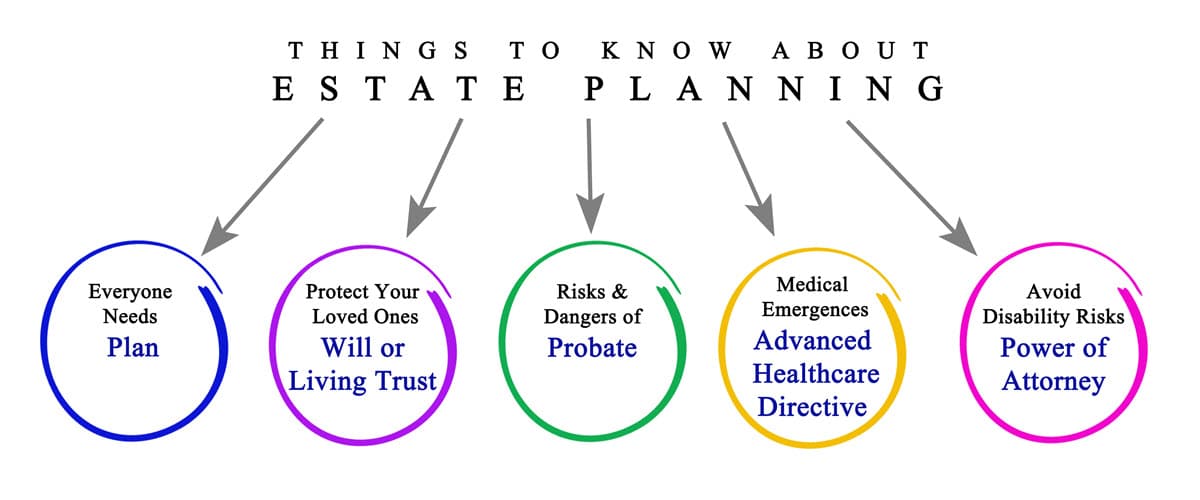

There are specific papers you'll require as component of the estate preparation process. Some of the most typical ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate planning is only for high-net-worth people. Estate intending makes it much easier for individuals to determine their dreams prior to and after they die.

The Estate Planning Attorney PDFs

You ought to begin planning for your estate as quickly as you have any kind of measurable property base. It's an ongoing procedure: as life proceeds, your estate plan must change to match your situations, in line with your brand-new objectives.

Estate planning is typically thought of as a tool for the well-off. That isn't the instance. It can be a useful way for you to handle your properties and responsibilities prior to and after you pass away. Estate planning is also a wonderful way for you to set out strategies for the treatment of your small children and animals and to describe your yearn for your funeral service and favorite charities.

Applications should be. Qualified candidates who pass the test will be officially licensed in August. If you're eligible to sit for the test from a previous application, you may file the short application. According to the regulations, no accreditation will last for a duration longer than five years. Discover out when your recertification application schedules.